Use the lead layout guide to ensure the section follows wikipedias norms and to be inclusive of all essential details. 60 of the gain is treated as a long term capital gain at a rate of 0 if you fall in the 10 15 tax bracket.

Forex Losses Tax Deductible Canada What Does Canada Trade With Uae

The tax rate remains constant for both gains and losses an ideal situation for losses.

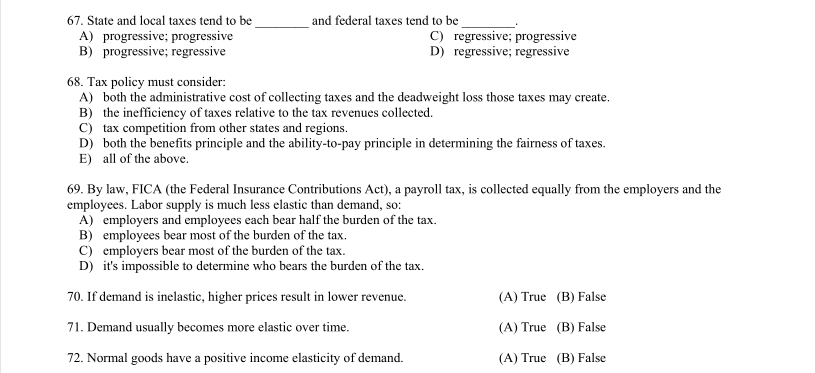

Forex income tax rate. Notably 1256 contracts while more complex offer 12 more savings for a trader with net ga! ins. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for list of countries by personal income tax rate. The 40 of the gains are considered to be short term and will be taxed at your usual income tax rate.

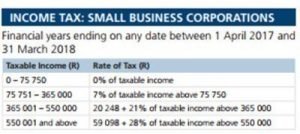

Forex traders who trade in their individual capacity and special trusts are subject to the following income tax rates. These are the rates and the income thresholds for single filers as of january 1 2018. Income tax rates and bands the table shows the tax rates you pay in each band if you have a standard personal allowance of 12500.

The lead section of this article may need to be rewritten. Income tax slab rates wont apply in this case and tax at 30 flat shall be computed on the total income. Please discuss this issue on the articles talk page.

Income tax bands are different if you live in scotland. Short term gains are for assets held for one y! ear or less. Rates of tax for individuals.

! Tax rates for short term gains are 10 12 22 24 32 35 and 37. The rate that you will pay on your gains will depend on your income. Surcharge is also levied in case of firms and local authorities as per the below mentioned schedule.

Below is a breakdown of all the state income tax rates. If you fall into the 25 35 tax bracket it will be 15 and it will be 20 if you fall into the 369 tax bracket. 2020 tax year 1 march 2019 29 february 2020 no changes from the previous year.

Sars pocket tax guide 20172018 however traders are only required to pay income tax if their total income exceeds a certain annual threshold which is determined by their age. 2 to 5 percent.

Solved Let E Be The Direct Exchange Rate For Foreign Exch

Solved Let E Be The Direct Exchange Rate For Foreign Exch

How To Report Forex Profits Losses Finance Zacks

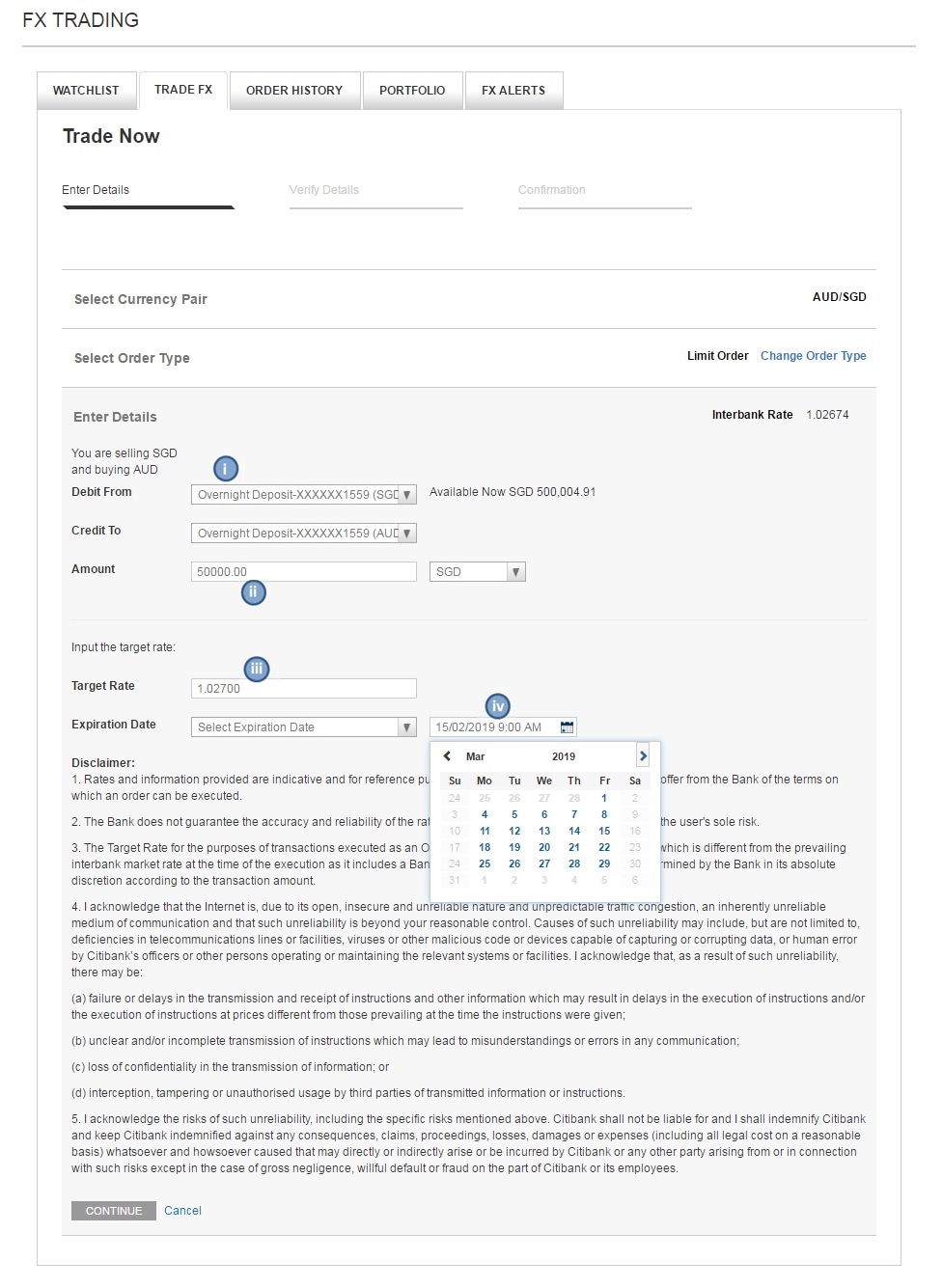

Online Foreign Exchange Trading Efx Citibank Singapore

Online Foreign Exchange Trading Efx Citibank Singapore

Day Trader Salary Infographic See How Much Top Traders Make

Day Trader Salary Infographic See How Much Top Traders Make

How To Report Forex Losses Finance Zacks

How To Report Forex Losses Finance Zacks

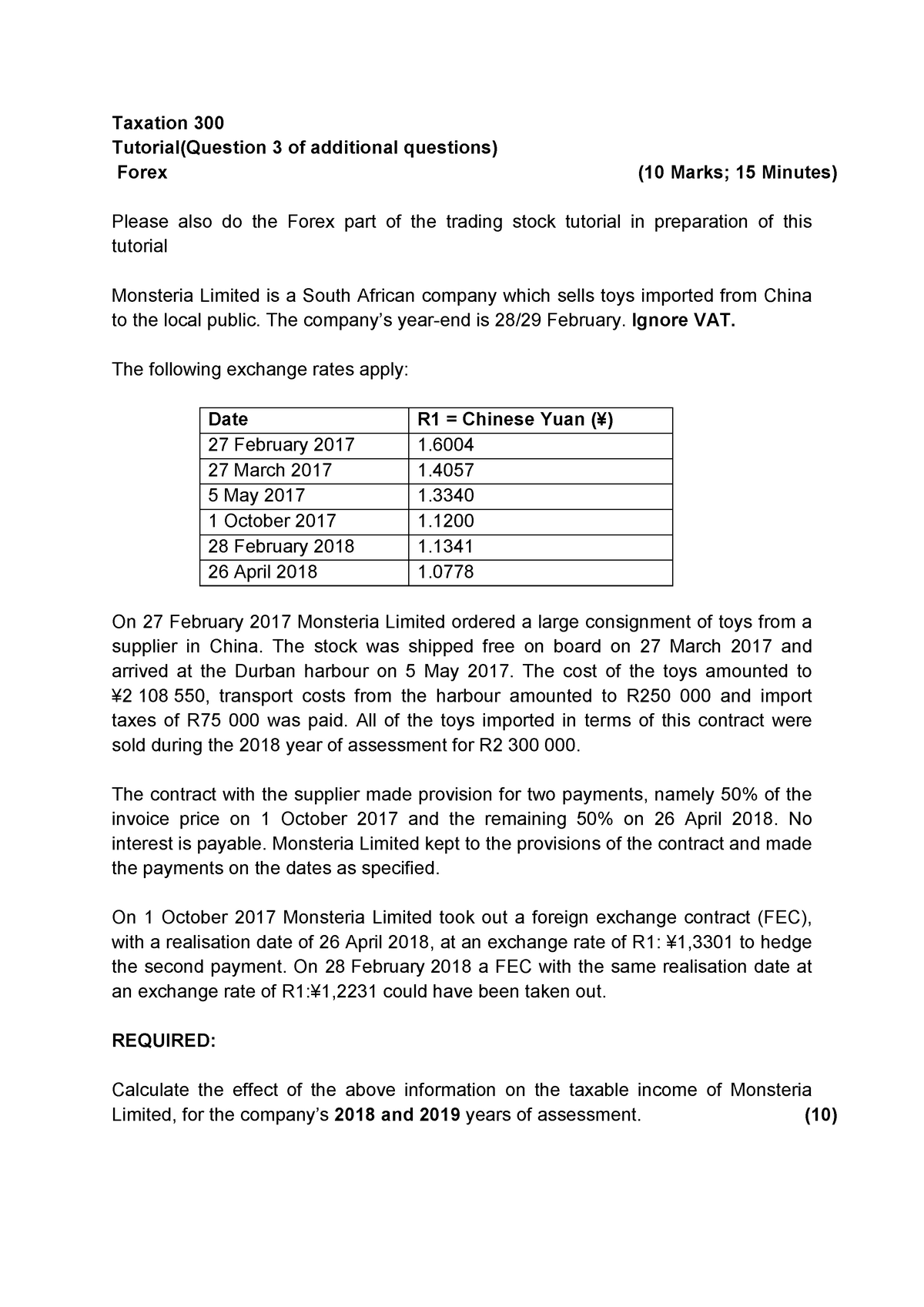

Foreign Exchange Tutorial Bel 300 Taxation Studocu

Foreign Exchange Tutorial Bel 300 Taxation Studocu

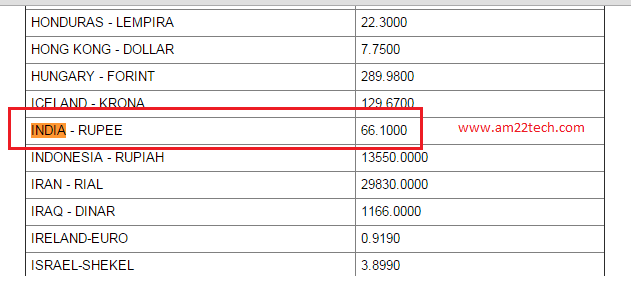

Irs Forex Rates Yearly Average Rates

Irs Forex Rates Yearly Average Rates

Forex Income Tax Canada How Do I Account For Online Forex Trading

Forex Income Tax Canada How Do I Account For Online Forex Trading

Foreign Exchange Market Wikipedia

Foreign Exchange Market Wikipedia

Pin By Dominic Walsh On Forex Trading Strategies Foreign Exchange

Pin By Dominic Walsh On Forex Trading Strategies Foreign Exchange

2019 Forex Trading In The Philippines What Is Legal What Is Not

2019 Forex Trading In The Philippines What Is Legal What Is Not

Tax Im! plications For South African Forex Traders Who Reside In South

Tax Im! plications For South African Forex Traders Who Reside In South

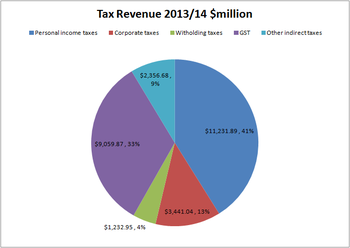

Taxation In New Zealand Wikipedia

Taxation In New Zealand Wikipedia

Forex Trading What Is It And How Does It Work Ig South Africa

Forex Trading What Is It And How Does It Work Ig South Africa

France Personal Income Tax Rate 2019 Data Chart Calendar

France Personal Income Tax Rate 2019 Data Chart Calendar

0 Response to "Forex Income Tax Rate"

Posting Komentar