Rsi is a very popular tool because it can also be used to confirm trend formations. Rsi is one of the first indicators that traders learn but often the finer intricacies are lost or ignored as traders move on to more advanced studies.

Tutorial Digest 3 Trading Tips For Rsi Trading Systems 29

Tutorial Digest 3 Trading Tips For Rsi Trading Systems 29

But being popular doesnt always make you right or easy.

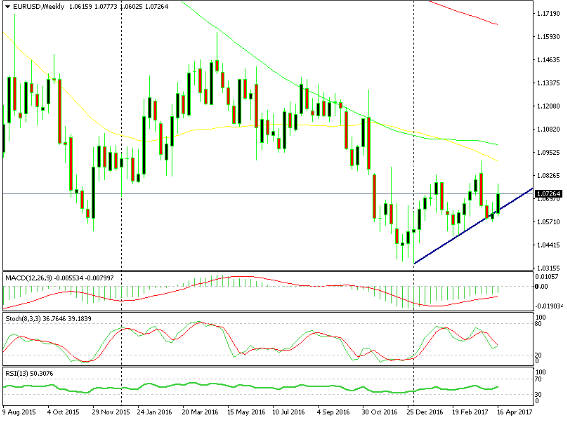

Forex what is rsi. If you are looking at a possible uptrend then make sure the rsi is above 50. If you think a trend is forming take a quick look at the rsi and l! ook at whether it is above or below 50. The rsi is viewed as a leading indicator in that its signals foretell that a change in trend is imminent.

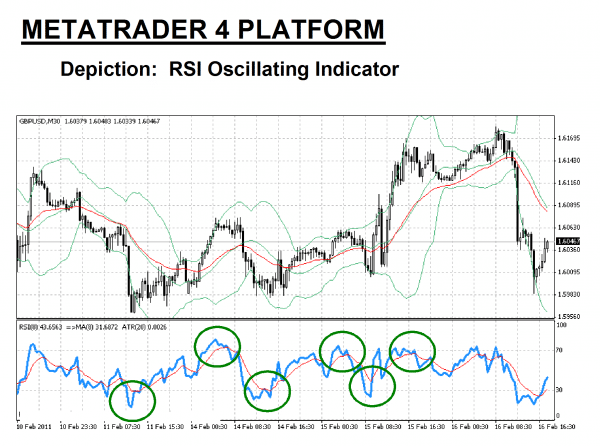

The relative strength index is arguably the most popular technical indicator when it comes to trading. The relative strength index rsi is most commonly used to indicate temporary overbought or oversold conditions in a market. The weakness in the indicator is that timing is not necessarily a product of the rsi the reason for attaching a lagging moving average to confirm the rsi signal.

Rsi indicates the how much the market is overextended or is under performing so that the ups and downs can be retraced well in advance. Rsi is being widely used to trace the market condition for an intraday forex trading. Rsi is used in forex stocks and in other forms of online trading.

In this article well investigate this. An intraday forex trading strategy can be devised to take adv! antage of. Rsi is scaled from 0 to 100.

! Generally speaking the rsi level of 70 or more indicates overbought market conditions while the rsi level of 30 minus indicates oversold market conditions. The relative strength index rsi is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. Default rsi 14 can be enhanced filtered with another shorter period rsi for example rsi 3 rsi 6.

The advantage a longer default rsi is that it uses a longer time period and thus produces less false signals however it will lag more. The rsi indicator is considered a leading indicator which means that its signals typically come prior to a price event on the chart. The rsi indicator is a technical trading tool that falls within the oscillator family.

If you are looking at a possible downtrend then make sure the rsi is below 50.

Forex Rsi Trading Strategy Free Rsi Forex Trading Strategy

Metro Rsi Metatrader 5 Forex Indicator

Metro Rsi Metatrader 5 Forex Indicator

Rsi Forex Trading Strategy With Support Resistance Level

!

Frz Ma Rsi Ea Robot Forex Robotz

Frz Ma Rsi Ea Robot Forex Robotz

Wie Funktioniert Das Rsi System Im Forex Trading

Wie Funktioniert Das Rsi System Im Forex Trading

Learn About Metatrader Rsi Settings A Simple Rsi Trading System

Learn About Metatrader Rsi Settings A Simple Rsi Trading System

How To Trade With Rsi In The Fx Market

How To Trade With Rsi In The Fx Market

Rsi Trading Strategy Simple To Learn Trading Strategy Updated 2019

Rsi Trading Strategy Simple To Learn Trading Strategy Updated 2019

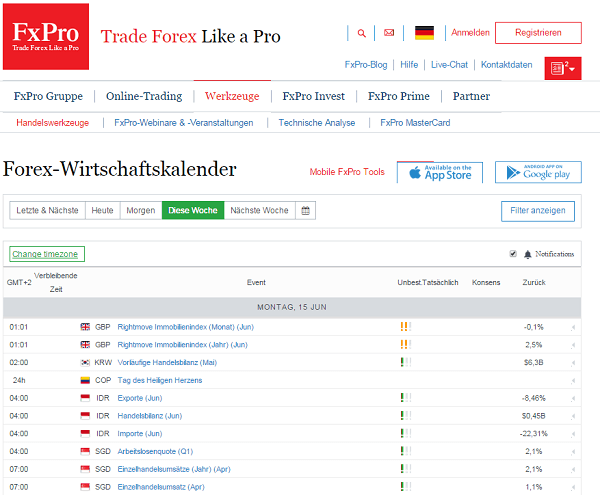

Forex Rsi Strate! gie 2019 Strategie Fur Devisenhandel Erklart

Forex Rsi Strate! gie 2019 Strategie Fur Devisenhandel Erklart

!  Detailed Rsi Guide How To Use Rsi To Generate Signals In Forex Trading

Detailed Rsi Guide How To Use Rsi To Generate Signals In Forex Trading

7 Rsi Trading Strategies That Can Tune Up Your Forex Trading

7 Rsi Trading Strategies That Can Tune Up Your Forex Trading

Most P! opular Indicators Relative Strength Index Rsi Trading

Most P! opular Indicators Relative Strength Index Rsi Trading

Adding To The Winner Macd And Rsi Forex Strategy Forex Strategies

Adding To The Winner Macd And Rsi Forex Strategy Forex Strategies

Double Top And Double Bottom In Rsi Strategy Technical Analysis

Double Top And Double Bottom In Rsi Strategy Technical Analysis

How To Trade Rsi Divergence

How To Trade Rsi Divergence

0 Response to "Forex What Is Rsi"

Posting Komentar